Contents

On this page

What is Council Tax?

Council Tax is a local tax that helps to pay for a wide range of public services in your borough.

Each household receives a bill and the amount each household pays depends on which property valuation band the home is in and any discounts or exemptions that apply.

There are 8 valuation bands which relate to the value of the property on 1 April 1991, with the value of new properties being assessed back to this date.

In addition to Merton’s Council Tax, the Council also collect an amount of Council Tax on behalf of the GLA, and households within three quarters of a mile of Wimbledon Common are required to pay an additional levy for Wimbledon and Putney Commons Conservation.

Council tax charges and bands

The amount of council tax you pay depends on which of the eight bands your home comes under.

We use band D charge as the basis for working out the charge for the other bands. For example, the charge for a band D property for 2024/25 is £1,993.38.

To work out the cost of a band A property in the main part of the borough it’s £1,993.38 x 6/9.

| Band | Property value (on 1 April 1991) | Proportion of band D charge | Council tax charge (main part of borough) |

|---|---|---|---|

| A | Up to £40,000 | 6/9 | £1,328.92 |

| B | £40,001–£52,000 | 7/9 | £1,550.40 |

| C | £52,001–£68,000 | 8/9 | £1,771.89 |

| D | £68,001–£88,000 | 9/9 | £1,993.38 |

| E | £88,001–£120,000 | 11/9 | £2,436.36 |

| F | £120,001–£160,000 | 13/9 | £2,879.33 |

| G | £160,001–£320,000 | 15/9 | £3,322.30 |

| H | £320,001 upwards | 18/9 | £3,986.76 |

If you live within the area of Wimbledon and Putney Common you pay an extra £39.15 (Band D) to cover the expenses of the Commons Conservators. Including this charge, the Band D charge is £2,032.53.

You may not have to pay the full council tax charge as you may be entitled to a discount or an exemption

What council tax helps pay for

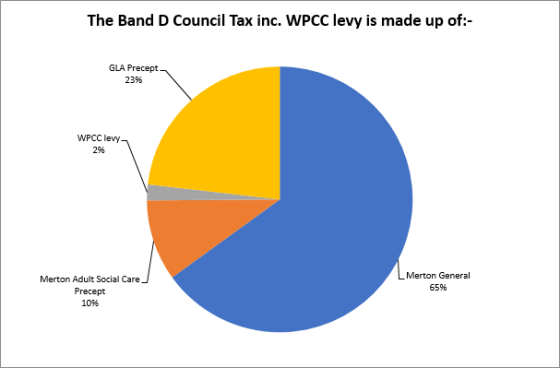

Council tax helps pays for the local services we provide. With the introduction of the Adult Social Care Levy there are four main elements to the charge:

- spending on local services, such as education, waste collection, green spaces, and care services including levies , which the Council is required by statute to pay to the Environment Agency, the London Pension Fund Authority, and Lee Valley Regional Park.

- Spending on adult social care which is ring-fenced and funded by the Adult Social Care precept

- the GLA charge for the services they provide, such as police and fire services which is collected by the Council and passed to the GLA

- If you live within the area of Wimbledon and Putney Common you pay an extra £39.15 (Band D) to cover the expenses of the Commons Conservators.

| Merton's Band D Council Tax | 2023/24 £ | 2024/25 £ | Change £ | Change % |

|---|---|---|---|---|

| Merton General Precept | 1,278.06 | 1,321.37 | ||

| Merton Adult Social Care Precept | 171.62 | 200.61 | ||

| Merton Band D exc. WPCC | 1,449.68 | 1,521.98 | 72.30 | *5.0% |

| GLA Precept | 434.14 | 471.40 | 37.26 | 8.6% |

| Merton Band D inc. GLA exc. WPCC | 1,883.82 | 1,993.38 | 109.56 | 5.8% |

| WPCC | 35.96 | 39.15 | 3.19 | 8.9% |

| Merton Band D inc. WPCC & GLA | 1,919.78 | 2,032.53 | 112.75 | 5.9% |

*Of the 5% increase in Council Tax, 3% (£43.31) is for Merton’s general precept and 2% (£28.99) is for the Adult Social Care Precept.

Average Council Tax

The Government require the Council to express its Council Tax as an average. Merton’s average 2024/25 Band D council tax is £1,527.88. i.e. across the Council’s area most properties pay the general Council tax but some properties also pay the Wimbledon and Putney Commons Conservators levy. The total council tax raised for Merton’s services across the borough is then converted to an average although no properties pay the average, they either pay the Merton Council Tax (Band D = £1,521.98) or the Merton + WPCC Council Tax (Band D = £1,561.13).

The 2024/25 average council tax (Band D) including the GLA precept is £1,999.28.

Precept

Local authorities with responsibility for social care, such as Merton, may levy a precept to

spend exclusively on adult social care. For 2024/25, without triggering the need for a local referendum, councils such as Merton are able to increase their council tax level by up to 5% (comprising 2% for adult social care precept, and 3% for other expenditure). The 2024/25 Adult Social Care precept (Band D) has been set at £28.99 (2%).

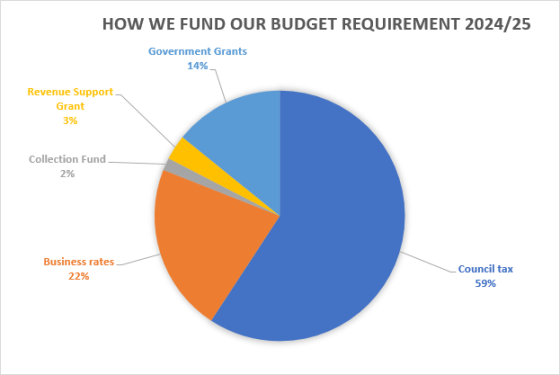

How is Council Tax calculated?

- we plan our services for the coming year and work out how much they will cost to provide

- we deduct any income that we expect to receive during the year from fees and charges, government grants and other contributions, and a share of business rates (30%)

- the resulting balance is the amount we need to fund from Council Tax. The Council Tax is calculated by dividing this figure between all properties in the borough, taking into account the different Council Tax property bands.

- Main income sources in 2024/25 and amount raised per head.

| Funding sources 2024/25 | £m | % | £/head* |

|---|---|---|---|

| Government Grants | 28.6 | 14.2% | £132.98 |

| Business rates | 43.9 | 21.8% | £204.09 |

| Revenue Support Grant | 6.5 | 3.2% | £30.27 |

| Collection fund | 3.2 | 1.6% | £15.06 |

| Council tax requirement | 119.6 | 59.2% | £555.65 |

Medium Term Financial Strategy (MTFS)

You can view our financial plans for the next four years in our Medium Term Financial Strategy

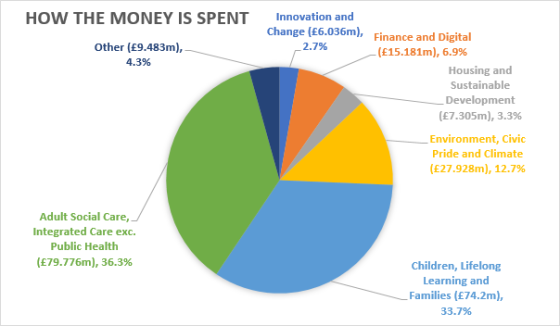

The services we deliver

This table shows the amount we plan to spend on council services in 2024 to 2025 compared to last year.

| 2023/24 | 2024/25 | ||||||

|---|---|---|---|---|---|---|---|

Gross Expenditure £000's | Income £000's | Net Expenditure £000's | Gross Expenditure £000's | Income £000's | Net Expenditure £000's | ||

| Innovation & Change | 23,250 | (20,384) | 2,866 | Innovation & Change | 26,596 | (20,561) | 6,036 |

| Finance & Digital | 91,735 | (80,469) | 11,266 | Finance & Digital | 90,890 | (75,709) | 15,181 |

| Housing & Sustainable Development | 22,762 | (17,483) | 5,279 | Housing & Sustainable Development | 25,861 | (18,556) | 7,305 |

| Environment, Civic Pride & Climate | 67,654 | (46,801) | 20,853 | Environment, Civic Pride & Climate | 72,815 | (44,887) | 27,928 |

| Children, Lifelong Learning & Families | 269,315 | (199,749) | 69,566 | Children, Lifelong Learning & Families | 305,448 | (231,248) | 74,200 |

| Adult Social Care & Integrated Care | 93,703 | (25,716) | 67,987 | Adult Social Care & Integrated Care | 106,327 | (26,551) | 79,776 |

| Other | 11,017 | 0 | 11,017 | Other | 9,483 | 0 | 9,483 |

| Net Service Expenditure | 579,436 | (390,602) | 188,834 | Net Service Expenditure | 637,420 | (417,512) | 219,909 |

| Corporate Provisions/Appropriations | 26,001 | (32,763) | (6,762) | Corporate Provisions/Appropriations | 25,412 | (43,465) | (18,053) |

| Net budget requirement | 605,437 | (423,365) | 182,072 | Net budget requirement | 662,832 | (460,977) | 201,856 |

| Memorandum: *Public Health | 12,470 | (12,470) | 0 | Memorandum: *Public Health | 13,660 | (13,660) | 0 |

*Public health funding is provided by the NHS and is not part of our services. We have included it to show that it is money we are responsible for although it has no effect on the level of council tax set

Planned spending for 2024-25

This chart shows the budgeted spend on services in a pie chart from the 2024 to 2025 income and expenditure table

Changes in our revenue spend from 2023-24 to 2024-25

Our spending has gone up from £182.072m in 2023-24 to £201.856m in 2024-25.

| Item | £000 |

|---|---|

| Revenue Spending 2023/24 | 182,072 |

| Savings in Service Provision | (2,159) |

| Growth in Service provision | 5,166 |

| Social Care | 4,921 |

| Pay and Price increases (Net) | 11,527 |

| Provision against service shortfalls | 4,170 |

| Other adjustments, concessionary fares, income etc. | 5,088 |

| Capital financing and Investment Income | (5,640) |

| Appropriations to/(from) reserves | (3,289) |

| Budget Requirement 2024/25 | 201,856 |

Levies

These are the bodies we pay levies to. These are set by the bodies and we do not have a choice in paying these.

| Levy | 2023/24 £ | 2024/25 £ |

|---|---|---|

| Lee Valley Regional Park | 197,385 | 202,188 |

| Environment Agency: Flood Defences | 183,743 | 186,362 |

| London Pensions Fund Authority | 254,302 | 24,710 |

| Wimbledon and Putney Commons Conservators | 422,948 | 461,263 |

| Total Levies | 1,058,378 | 874,523 |

Borrowing

We estimate our long-term borrowing to fund capital programme projects which help improve the borough’s economic well-being, to be £52m as of 31 March 2024.

It is expected that this will remain at £52m at 31 March 2025.

The interest charges arising on this amount are financed from the council’s resources.

Staff

We estimate the number of staff we will employ (calculated on a full-time basis) in 2024/25 to be 2,081. This compares with a total of 2,045 in 2023/24.